Last month, a team managing $129 billion in client assets broke away from Merrill Lynch to launch their own registered investment advisor, OpenArc Corporate Advisory. It was a blockbuster move that was years in the making, and Merrill immediately filed suit, calling it a “premeditated corporate raid.”

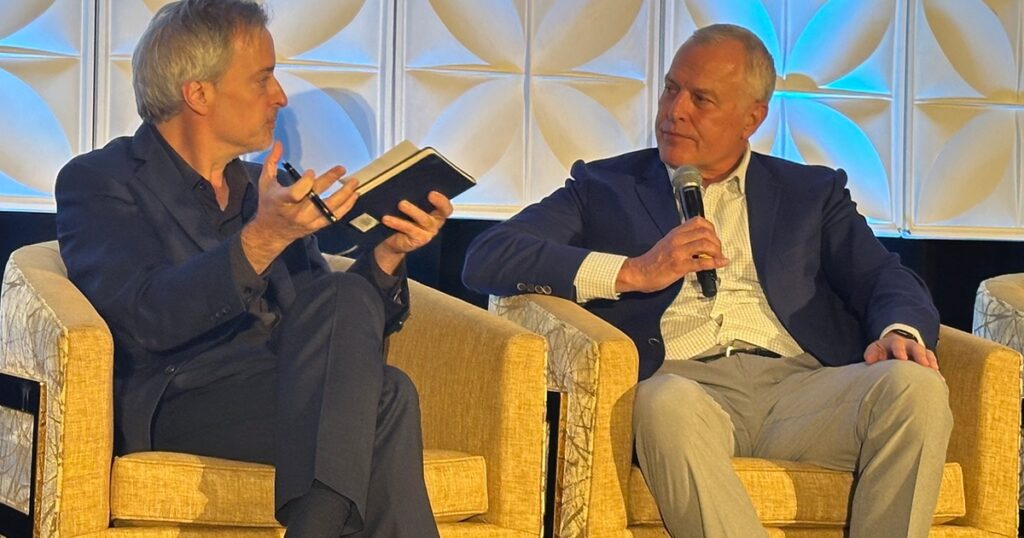

John W. Thiel, the former head of Merrill Lynch Wealth Management who launched his own RIA last year, weighed in on the OpenArc move this week, calling it a “watershed” for the industry during RIA Edge Los Angeles. Thiel said he applauded the team’s courage, but he doesn’t expect the firm to bring over all the assets. Approximately $100 billion of OpenArc’s assets are comprised of stock plans and 401(k) retirement accounts, according to published reports.

“It’s not like you send them an ACAT; they’re fiduciaries,” Thiel said, referring to the corporate stock plans. “I don’t think it’s going to be quite as big as it’s advertised because again, I don’t think those plans can just get up and walk out.”

Aside from the stock plans, OpenArc has a robust wealth management business, and Thiel said it’ll be able to serve them more effectively as an RIA. OpenArc should serve as a warning for the industry to pay closer attention to the advisor-client relationship. Many organizations don’t pay attention, which is a significant reason why he founded Indivisible Partners.

“Why we did this is to put the advisor and the client back out front,” he said.

Thiel launched Indivisible Partners last year to serve as an “accelerator” for ambitious advisors seeking to grow their businesses. They’ve added four advisor teams so far, and have another two signed on.

Thiel said he and his team felt “stifled” in the wirehouse environment and were attracted to the flexibility and innovation in the independent space.

“We wanted a blank sheet of paper because there were a lot of things we couldn’t get done at a big organization, especially when we got acquired by a money center bank,” he said. “Two, we just felt like our work wasn’t done. … We felt like there was something we owed advisors and clients that we didn’t get done. We thought we could do it. We’re not looking to be a $500 billion RIA, and we want to be really relevant and really good at what we do with people who want to share our same values and support those.”

Thiel has found the RIA community to be quite different from the wirehouses, in that they are open and willing to share best practices.

He said Indivisible’s model is differentiated from others because its tech stack is integrated and interoperable. His firm’s economic model is also unique. Each team owns 100% of their business, but they also all get equity interest in the broader partnership. So they participate alongside every other team in everybody’s growth.

Another difference is that Indivisible does not have private equity backing. The firm raised its own capital from its founders, family and friends.

Thiel said it could be a dangerous model because many of the outside investors are looking for a return, an exit.

“There is an end to this dance; the musical chairs are going to run up,” he said. “I’m not begrudging anybody for monetizing their practice and realizing the value of their life’s work. What I’m saying is, I think, though, that because of that tension to produce a return for that investor, it could be at odds with your legacy or your plan at some point in time. That’s all I’m suggesting. We just wanted to avoid that.”

Thiel expects the RIA to grow to $100 billion over the next decade.

“Our aspiration is to help teams, like-minded people, build a practice, take care of their clients and ultimately help them realize the value of their life’s work—ideally in a very seamless transition to a team of successors that the clients know and trust and will still benefit from that relationship and provide the flexibility for that selling advisor to structure what that looks like,” he said.