ASML’s stock has risen nearly 40% this year.

It’s profiting from the secular expansion of the AI market.

But its stock looks expensive, and it faces some unpredictable headwinds.

10 stocks we like better than ASML ›

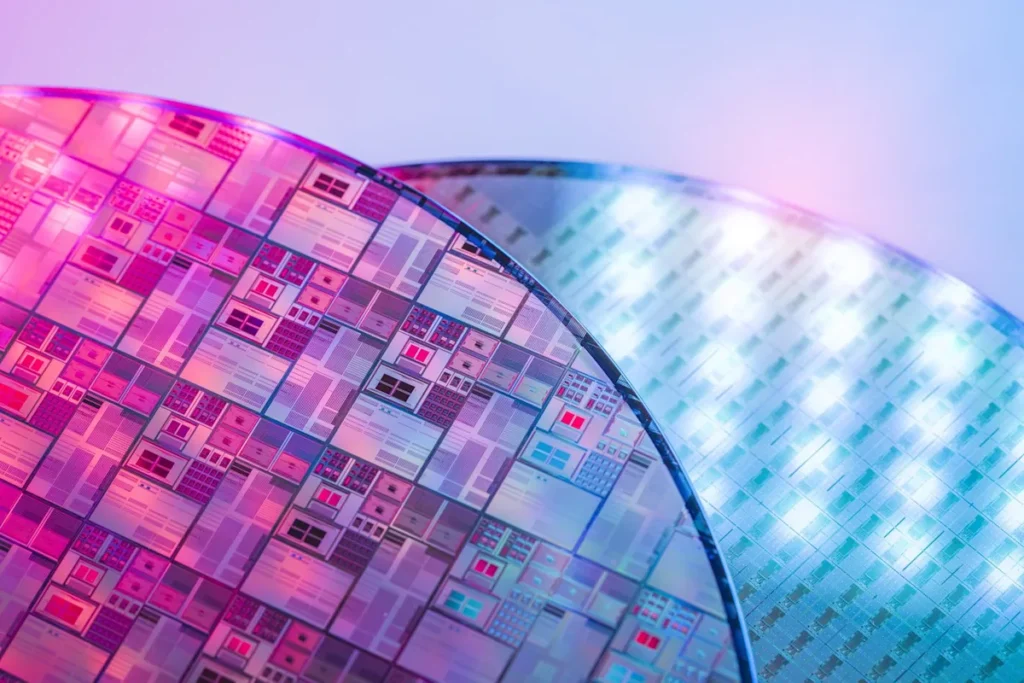

ASML (NASDAQ: ASML) is the world’s leading producer of lithography systems, which are used to optically etch circuit patterns onto silicon wafers. Most of the world’s leading chipmakers use its deep ultraviolet (DUV) lithography systems to manufacture their older and larger chips.

The Dutch tech giant is also the only producer of extreme ultraviolet (EUV) lithography systems, which are required to manufacture the world’s smallest and densest chips. All of the world’s leading foundries — including Taiwan Semiconductor (NYSE: TSM), Samsung, and Intel (NASDAQ: INTC) — use ASML’s EUV systems to produce their most advanced chips.

Image source: Getty Images.

ASML’s monopolization of that crucial technology makes it a linchpin of the semiconductor market. The market’s bullish enthusiasm for artificial intelligence (AI)-oriented chips fueled its rally of nearly 40% this year — but is it worth buying before its next earnings report on Oct. 15?

In 2023, ASML’s net sales surged 30% as it shipped more DUV and EUV systems, its service revenues rose, and more chipmakers ramped up their production of AI-oriented chips. It also gradually rolled out its latest “high-NA” EUV systems, which are used to produce even smaller and denser chips than its current generation of “low-NA” EUV systems.

But in 2024, its net sales only rose 3%, its gross margin flatlined, and its earnings per share (EPS) fell 3%. That slowdown was caused by tough comparisons to the AI market’s initial growth spurt, soft demand for non-AI chips, and tighter restrictions on its sales of higher-end DUV systems to China (where it’s already barred from selling EUV systems). Its existing customers also ordered fewer new systems as they worked through their existing inventories.

However, most of that slowdown occurred in the first half of 2024. Over the past four quarters, its net sales and EPS increased by the double digits as its gross margins expanded again. That recovery was largely driven by AI tailwinds for the DRAM memory chip market.

Metric

Q2 2024

Q3 2024

Q4 2024

Q1 2025

Q2 2025

Net Sales Growth (YOY)

(9.5%)

11.9%

28%

46.4%

23.2%

Gross Margin

51.5%

50.8%

51.7%

54%

53.7%

EPS Growth (YOY)

(18.7%)

9.8%

31.5%

92.9%

47.1%

Data source: ASML. In euros. YOY = Year-over-year.

Story Continues

ASML achieved that recovery even as it grappled with the Trump administration’s unpredictable tariffs, tighter export curbs, and the higher costs of rolling out its high-NA EUV systems. For the full year, it expects its net sales to rise 15% as its gross margin rises from 51.3% to about 52%. That bright outlook, along with the accelerating demand for more AI-related chips, drove more investors back toward ASML as a balanced play on the semiconductor market.

Analysts expect ASML’s revenue and earnings per share (EPS) to rise 14% and 25%, respectively, this year. From 2024 to 2027, they expect its revenue and EPS to grow at a compound annual growth rate (CAGR) of 10% and 16%, respectively.

ASML’s future looks bright, but a few issues could cap its near-term gains. First, its stock isn’t cheap at 34 times next year’s earnings. The bulls will argue that its dominance of the lithography market justifies its higher valuation, but the bears will claim that too much AI hype has been baked into its stock price. Therefore, any near-term hiccups could spook the bulls and sink its stock.

Second, ASML faces a lot of those near-term challenges. The Chinese government just tightened its import controls on Nvidia‘s (NASDAQ: NVDA) AI chips and issued new export restrictions on its rare earth elements used to manufacture semiconductors. The U.S. Senate also passed new export limits on Nvidia’s and AMD‘s (NASDAQ: AMD) AI chip sales to China, while President Donald Trump just threatened China with even higher tariffs.

All that pressure could throttle the growth of the global semiconductor market and force ASML to rein in its near-term sales forecasts. At the same time, ASML still needs to increase its spending to ramp up its production of its high-NA EUV systems. If it warns of slowing sales and rising costs, its stock will stumble.

I’ve owned ASML’s stock for more than four years, but I wouldn’t rush to accumulate more shares ahead of its third-quarter earnings report. Instead, it might be smarter to see if it addresses its near-term challenges and revises its guidance during that report before paying a premium valuation for its stock.

Before you buy stock in ASML, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ASML wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004… if you invested $1,000 at the time of our recommendation, you’d have $657,979!* Or when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $1,122,746!*

Now, it’s worth noting Stock Advisor’s total average return is 1,060% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

See the 10 stocks »

*Stock Advisor returns as of October 7, 2025

Leo Sun has positions in ASML. The Motley Fool has positions in and recommends ASML, Advanced Micro Devices, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.

Is ASML Stock a Buy Before Oct. 15? was originally published by The Motley Fool