A well-followed pseudonymous analyst on X (known as Pentoshi) said Friday he started a small position in HYPE, Hyperliquid’s native token, and will add only if prices drift lower.

In his Oct. 17 post, he wrote that he “nibbled” on spot HYPE below $34, filling about 20% of the position he ultimately wants. Spot means he bought the token itself without leverage, which removes the risk of forced liquidations. He said he’d “load up” nearer $28 and “go hard” sub-$30, a scale in approach that spaces buys across levels instead of committing all capital at once.

The setup, he stressed, sits inside a broader downtrend. By “lower highs,” he means each rebound is failing beneath the prior peak — a classic bearish structure that often resolves with another leg down. When he says there’s “broken market structure,” he’s pointing to damaged support zones and thin order books after last week’s volatility, conditions that can exaggerate moves and produce whipsaws. The takeaway: keep size small, avoid trying to nail an exact bottom, and assume dips can overshoot.

Pentoshi also flagged a potential supply overhang from an unstaking queue. On networks that allow staking, previously locked tokens periodically unlock; if a chunk of those coins is sold rather than restaked, short-term sell pressure can rise. He said he doesn’t know whether a quarter, a third, or less will hit the market, so he’s leaving resting bids below current price and letting the market come to him instead of chasing strength.

He added that a recent ether trade that strayed from his rules “burnt” him a bit — even if a bounce helped — so he’s playing defense: smaller sizing, pre-set bids, and minimal micromanagement of this position in the near term.

Hyperliquid is a decentralized exchange that runs on its own chain and is used mainly for perpetual futures — derivatives with no expiry. Its token, HYPE, serves as both governance and economic stake: holders can vote on upgrades, stake for rewards, and benefit from mechanisms that link trading activity and fees to the token’s value. In short: Hyperliquid is the venue; HYPE is how users share in its growth.

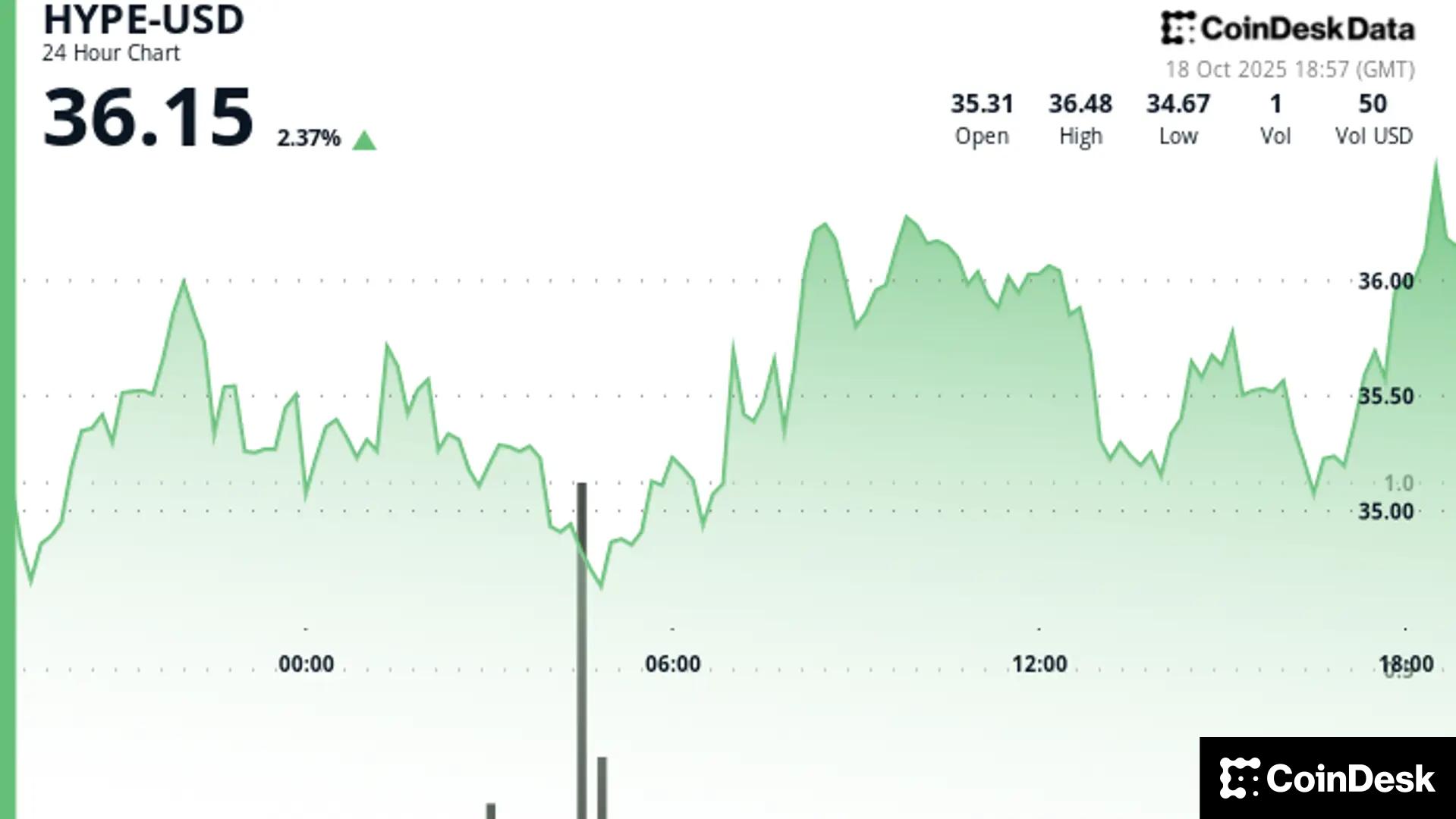

According to CoinDesk Data, just prior to publish time, HYPE was around $36.32, up 2.1% in the past 24 hours.