Key Takeaways

- The latest wave of optimism around AI helped lift tech stocks on Wednesday, Oct. 8, 2025, while competition weighed on a credit score provider.

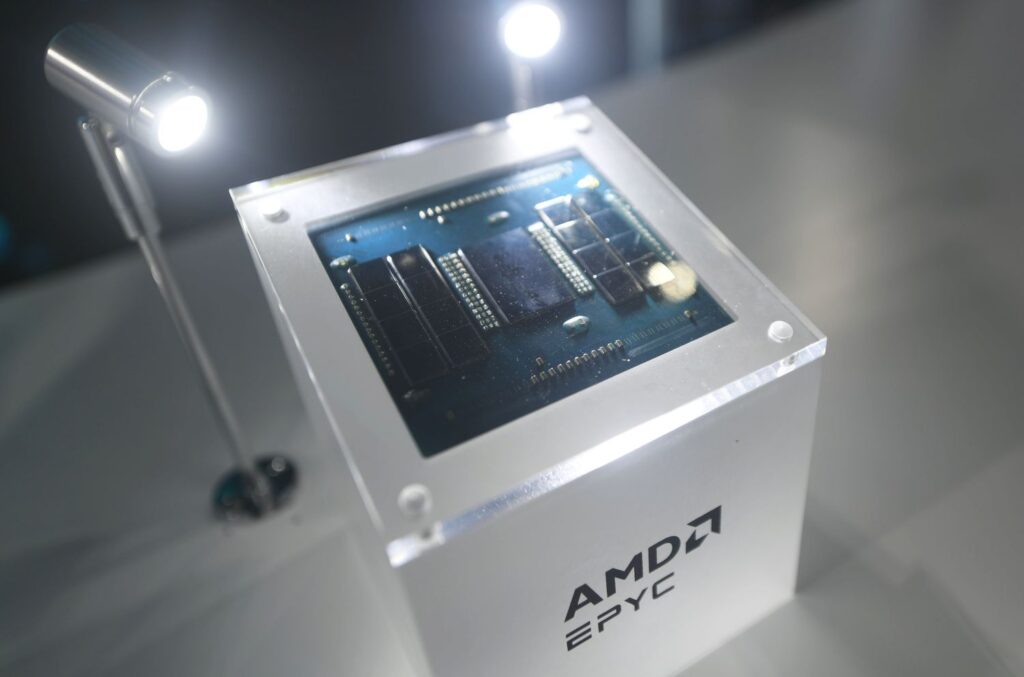

- Shares of AI chipmaker Advanced Micro Devices extended their recent rally, along with shares of server maker Dell.

- Equifax said it would offer credit scores to consumers at reduced prices, and shares of rival credit data provider Fair Isaac tumbled.

An AI chipmaker’s stock extended its rally in the wake of a major artificial intelligence deal. Meanwhile, the latest salvo in an escalating competition between credit score providers weighed on one of the industry’s big players.

The S&P 500 rose 0.6% and the tech-heavy Nasdaq climbed 1.1% to set fresh closing highs, bolstered by gains in the tech sector and minutes from the latest Federal Reserve meeting suggesting the central bank could be on track toward more interest-rate cuts this year. The Dow was little changed. Find Investopedia’s full daily market recap here.

Advanced Micro Devices (AMD) shares posted the day’s best performance in the S&P 500 index with a nearly 12% jump, extending their winning streak following the announcement of a partnership with OpenAI. A slew of analysts have raised their price targets for AMD this week, with Jefferies upgrading its rating to “buy” from “hold.”

Dell Technologies (DELL) shares surged 9.1%, after the server maker raised its outlook, citing strong demand driven by the buildout of AI infrastructure. CEO Michael Dell said the company’s broad portfolio of tech products makes it well positioned to provide the compute, storage, and network capacity necessary to deploy AI at scale.

Optimism around AI helped boost other companies with exposure to the burgeoning technology as well. Shares of AI chip leader Nvidia (NVDA) rose about 2% after CEO Jensen Huang said in a televised interview with CNBC that AI demand is up “substantially” this year, and that he expects it to keep growing.

Equifax (EFX) announced it will provide its VantageScore 4.0 credit scores at a reduced price or free to customers, just days after Fair Isaac (FICO) said last week that it would offer its FICO credit scores directly to firms that provide credit reports to lenders, reducing reliance on Equifax and the other nationwide credit bureaus. Fair Isaac shares dropped nearly 10%, losing the most of any S&P 500 stock Wednesday and reversing a portion of the gains posted after last week’s announcement, while Equifax shares advanced close to 1%.

Live Nation (LYV) shares fell 3.4% after the Ticketmaster parent announced a plan to offer $1.3 billion in convertible senior notes maturing in 2031. The live entertainment company intends to use the proceeds of the transaction to redeem senior notes due in 2026, repay other debt, and for general corporate purposes.