Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

The US Treasury has intervened in Argentina’s currency market for the first time, as the Trump administration tries to help its ally President Javier Milei contain a run on the peso.

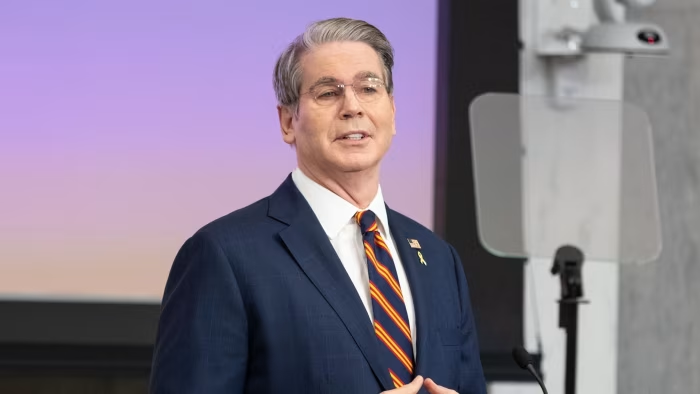

Treasury secretary Scott Bessent said the institution had “directly purchased Argentine pesos” on Thursday to boost the currency, after Argentine authorities rapidly burnt through their own reserves in recent weeks. Since 1996, the US has only intervened in currency markets three times prior to Thursday’s move, according to the New York Fed.

The highly unusual US intervention comes as Milei, President Donald Trump’s most important ideological partner in Latin America, battles a crisis of confidence ahead of midterm elections on October 26.

Bessent added that the US had “finalised a $20bn currency swap framework” with Argentina’s central bank. He said the success of Milei’s free-market reform programme was “of systemic importance”.

“Argentina faces a moment of acute illiquidity,” Bessent said. “The US Treasury is prepared, immediately, to take whatever exceptional measures are warranted to provide stability to markets.”

The peso has been under severe pressure since last month when Milei’s government fell into a political crisis and investors began to doubt the sustainability of his exchange rate policy, which has kept the peso strong in order to hold down inflation.

Argentina’s dollar bonds jumped on the news, with the 10-year yield — which moves inversely to price — down to 11.47 per cent, its lowest level since September. The Argentine peso strengthened by 0.6 per cent, reaching its strongest level in a week.

Shortly after Bessent’s announcement, Argentina’s economy minister Luis Caputo thanked the US Treasury secretary, expressing his “deepest gratitude for your unwavering support to Argentina”. “Your steadfast commitment has been remarkable,” he posted on X.

Milei has sought to keep the peso within fixed exchange rate bands and prevent it from devaluing sharply before the crucial elections at the end of the month.

Local economists estimate Argentina’s Treasury has nearly drained its liquid dollar reserves by selling $1.8bn in the past seven sessions to keep the peso away from the lower limits of the band.

International investors in Argentina’s dollar bonds had feared the country would burn through much of its reserves before this month’s election if it did not receive US support.

The central bank has about $13bn remaining from an IMF loan, which it can sell in currency markets when the peso hits the lower limit of the band under the terms of a bailout the fund delivered in April.

Bessent said the exchange rate band “remains fit for purpose” and that “Argentina’s policies, when anchored on fiscal discipline, are sound”.

Many independent economists have said the bands currently overvalue the peso, and prior to the US announcement, local dollar futures prices implied a substantial devaluation of the peso after the elections.

Recommended

The US Exchange Stabilization Fund, an emergency fund run by the US Treasury, most famously lent $20bn to support Mexico weeks after its currency collapsed in December 1994. The country drew down $12bn and repaid the US at a profit.

The ESF’s last high-profile direct FX intervention was as part of US and G7 efforts to sell the yen in 2011 after Japan’s earthquake that year.

Caputo has held four days of talks with Treasury officials this week. Milei is due to meet Trump at the White House on October 14.

Additional reporting by Joseph Cotterill in London